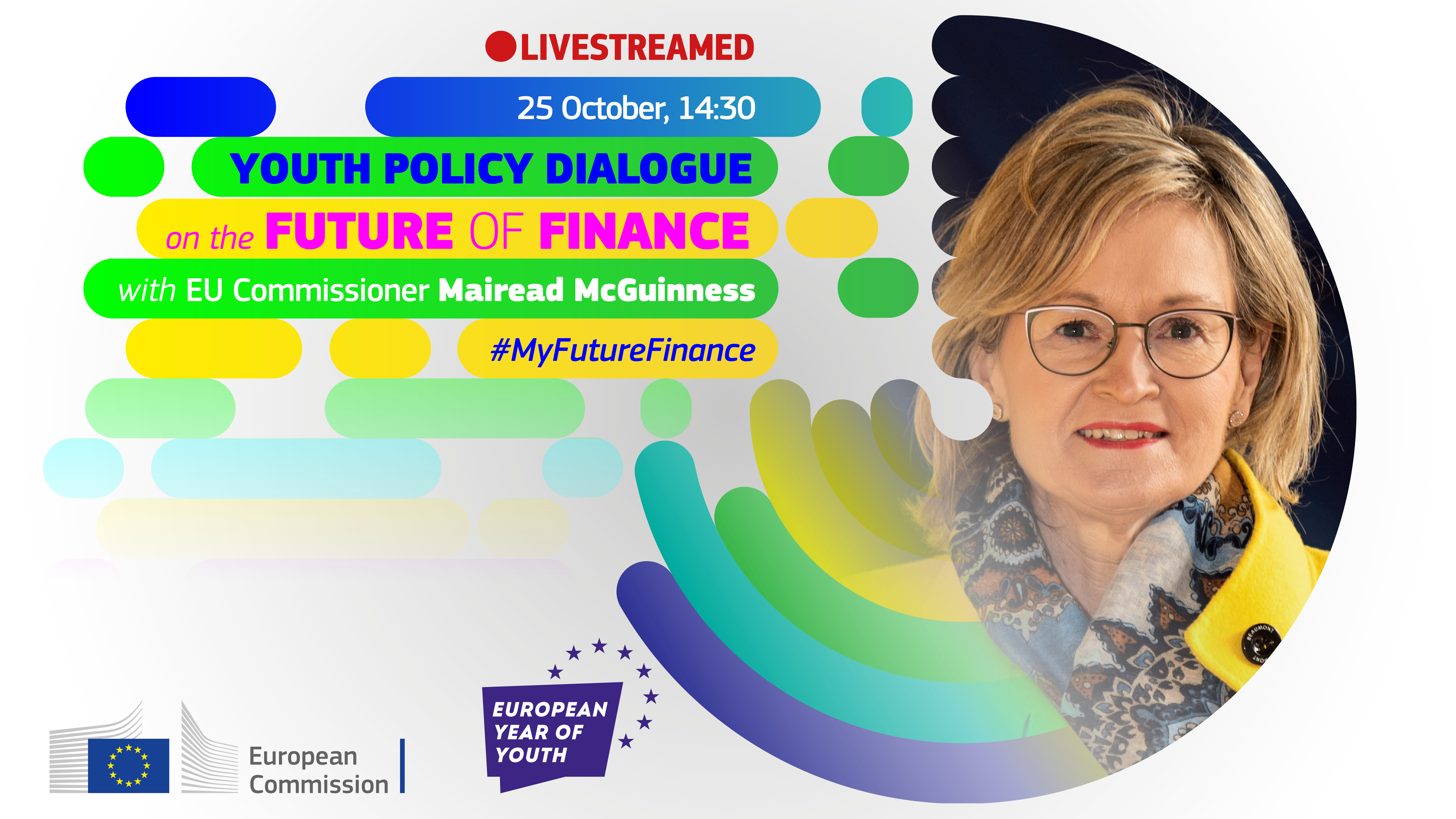

Policy Dialogue with Commissioner Mairead McGuinness: "The future of finance"

@© European Union, 2022

@© European Union, 2022

25/10/2022 14:30

25/10/2022 16:30

[CET] Central European Time

wifi_tethering Follow the live stream

Rue de la Loi, 200, 1049, Brussels, Belgium

As part of the European Year of Youth, Commissioner McGuinness held a dialogue with young people from throughout Europe about their vision for the future of finance.

Twelve participants were selected based on a contest inviting young people between 18 and 25 to submit videos on their vision for the future of finance.

The twelve winners of the contest were

- Rodrigo Baptista (Portugal)

- Viktor Biquet (France/Belgium)

- Chiara Bonalli (Italy)

- Christian Bonalli (Italy)

- Irene González Lobo (Spain)

- Evan Gorrell (Ireland)

- Carolina Grossetti (Italy)

- Josias Knöppler (Germany)

- Seweryn Kras (Poland)

- Catriona O'Halloran (Ireland)

- Mindy Parkkinen (Finland)

- Sophia Seeber (Austria)

The winners of the contest met the Commissioner in Brussels on 25 October 2022.

Did you miss the live discussion? Don't worry, you can watch the recorded version by accessing the European Commission live stream page.

Take aways from the Dialogue

1. Sustainable finance

- The importance of a just transition that leaves no one behind – in Europe but also globally.

- The need to standardize information on sustainable finance, for example ESG ratings, to ensure comparability and reliability and fight greenwashing.

- Rewards for companies that set high ESG standards; young people are also attracted to work for companies that prioritise ESG.

2. Digital finance

- The financial system is changing: new technologies like AI and blockchain and new developments like crypto and DeFi present both opportunities and risks.

- DLT and DeFi create the possibility of anonymous transactions making finance more open, accessible and equal, but this also creates concerns that malicious actors could leverage them to conduct money laundering, fraud, cyberattacks, or even terror attacks.

- Young people throughout Europe trust in the use of contactless digital payments and are enthusiastic for further developments in the field of digital currencies, such as a digital euro.

- Europe should make the most of such opportunities and support financial innovation, while keeping strong protections in place for financial stability as a whole and for individuals.

3. Financial literacy and inclusion

- An EU strategy or advertising campaign for financial literacy that goes beyond the EU’s existing financial literacy work. It should reflect:

- Young people should get access to financial literacy programmes in schools, either already in primary schools but definitely in secondary schools; another option would be to target parents to pass onto their children.

- Financial education should also be included beyond the traditional education system, to reach disadvantaged groups and those who missed out on financial education at school.

- Financial education/literacy with its focus on the individual should not be at the expense of collective measures to support social and economic well-being (eg social security).

4. General recommendation

- Young people’s views and interests should be mainstreamed in policy-making for financial services: for example, via the Youth Test, and/or via an annual youth policy dialogue.

Activity details

| Activity format | Hybrid (both online and with face-to-face presence) |

| Starts on | 25/10/2022 14:30 |

| Ends on | 25/10/2022 16:30 |

| Timezone | [CET] Central European Time |

| Organised by | European Commission |

| Target age range | 18-24; 25-30 |

| Language of the activity | English |

| Type of activity | Debate |

| Activity topics | Participation & engagement; Economy & finance |

| Youth Goals this activity is linked to | Connecting EU with Youth |

| Related to the Conference on the Future of Europe | No |

| Number of expected participants (estimate) | 12 |